The Myth of Diversification

Jan 19, 2023

Introduction

In the world of investing, diversification is often touted as a way to manage risk in a portfolio. The idea is that by investing in a variety of asset classes, such as stocks, bonds, and real estate, an investor can spread their risk and reduce the impact of any one investment on their overall portfolio.

However, during times of economic crisis, the correlation between asset classes often increases, meaning that they all tend to move in the same direction. This can lead to diversification failing as a risk management strategy. In this article, we will examine the myth of diversification and explore alternative ways to manage risk in a portfolio.

The problem with correlations

One of the main reasons that diversification can fail as a risk management strategy is that during times of crisis, the correlation between asset classes often increases.

First, a quick primer on what correlation is:

- If asset class A rises by 10% and asset class B also rises by 10%, they have a perfect correlation of 1.

- If asset class A rises by 10% and asset class B doesn't move at all, they have no correlation.

- If asset class A rises by 10% and asset class B falls by 10%, they have perfect negative correlation of -1.

Here is the big problem. Correlations are NOT static. They can and DO change.

What investors are not being told is that during market declines, correlations increase.

At that EXACT point you NEED correlations to be negative, they break down.

I will illustrate this with a couple of examples.

We begin with a traditional asset allocation portfolio, strategically allocated across large caps, mid-caps, small-caps, international equities, commodities, and real estate.

During the Great Financial Crisis, the U.S. stock market as measured by the S&P 500 Index fell by over 50% at its worse point.

As one can see by looking at the following graph, there was little difference between the performance of the asset allocation fund and the general market.

Why is that? Isn’t diversification supposed to help?

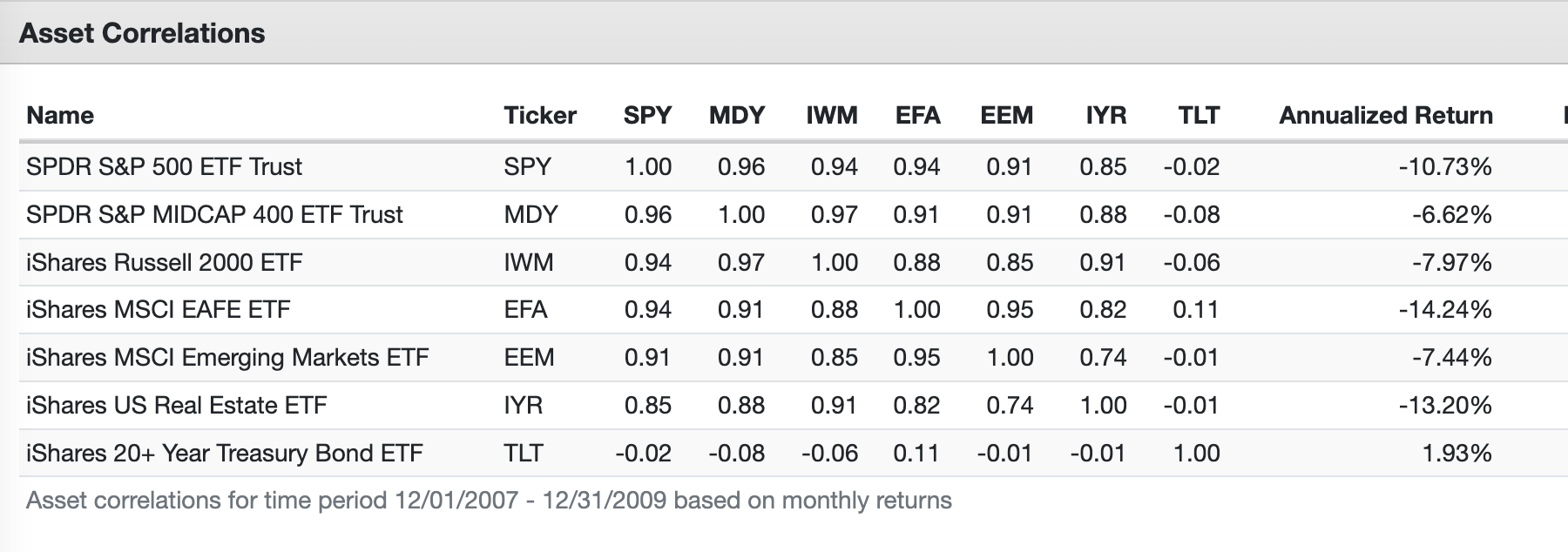

The answer lies here in this table which is arranged to show how each asset class compares to another on the basis of correlation.

Notice that nearly every asset class shows a correlation of .80 or higher. This explains why there was little performance difference between the “diversified” portfolio.

In this period, bonds did however provide some protection by displaying a negative correlation and a small positive return.

With 2022 still fresh in investors' minds, let's look at the same data.

It turns out in fact, that last year was even worse as the “diversified” portfolio returned less that the S&P 500.

Why?

Simple. Bonds often thought to mitigate risk in a portfolio, actually increased the risk. Here are the numbers.

And again it can be seen, that the correlation among the various securities remained high, with bonds now being the worst-performing asset class.

If you still aren’t convinced, here is another example to consider.

Target date funds are among the most popular choices among 401k plans. For many plans, they are the default choice because of the favorable view toward “diversified” portfolios.

But here again, the numbers come up short as the Target Date example performed worse than the S&P 500.

Do you see the benefit of diversification?

No?

I don't either.

If the goal of diversification is to minimize downside risk, it seems to be failing in living up to its promise, as it is commonly practiced.

The key to diversification is not the number of assets you own, but the lack of correlation among the assets you do own.

The legendary Fidelity manager, Peter Lynch, called it "diworsification" and maybe for good reason.

Diversification is often touted as a way to manage risk in a portfolio, but during times of crisis this has turned out to be not the case.

There are better ways to manage downside risk which will be explored in future articles.

The good news for investors is that every Drawbridge model uses rules-based, systematic processes to manage risk that is proven to by far more effective than traditional diversification practices.

Stay connected with news and updates!

Join the newsletter to receive the latest news and updates on building a more intelligent portfolio. Earn More. Risk Less.

I will never sell your information for any reason.