Dividend Investing in a Changing Landscape: Adapting to Rising Interest Rates

Mar 08, 2023

Dividends have historically been an important component of the overall stock market return. In fact, many investors view dividends as a crucial part of their investment strategy, particularly those who seek regular income from their investments.

Over the long term, dividends have contributed a significant portion of the total return for many stocks. According to a study by Hartford Funds, dividends accounted for approximately 42% of the total return for the S&P 500 Index from 1930 to 2020.

This means that almost half of the return from investing in the stock market has come from dividends. This highlights the importance of dividends for investors, and why they should be a consideration when building an investment portfolio.

While stock prices can be volatile in the short term, dividends can provide a steady stream of income that can help offset the impact of market fluctuations. Additionally, companies that pay consistent and growing dividends often have a track record of financial stability and profitability, which can be attractive to investors seeking quality companies to invest in.

But today, dividend investors are facing some challenges that they have not had to deal with for decades.

The Challenge

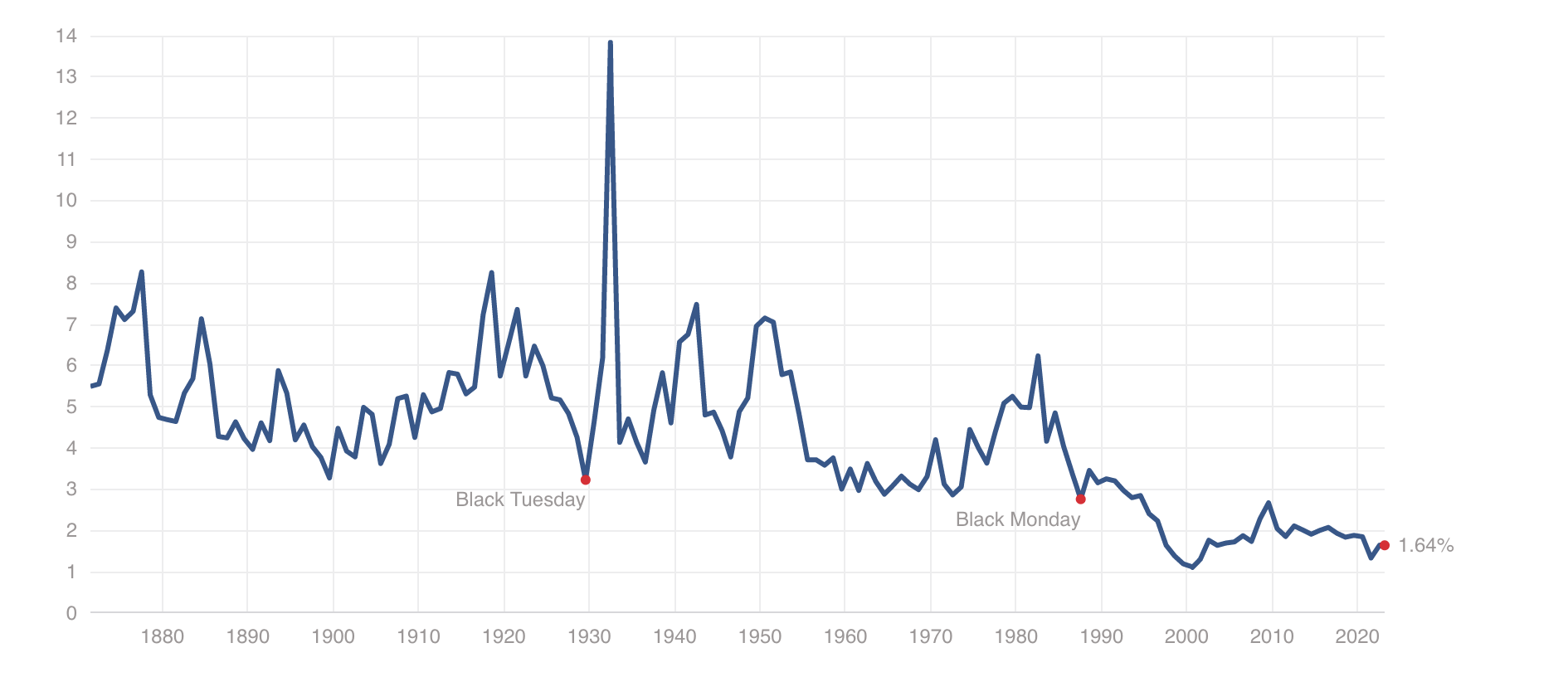

The S&P 500 Index, which tracks the performance of 500 large-cap US stocks, has had an average dividend yield of around 4.4% since its inception in 1926.

At the end of the 1970s, before the greatest bull market of all time lifted off, the S&P 500 dividend yield peaked at 5.36%.

Today, however, the yield is only 1.64%.

Only in recent years, post-2009 to current, have yields offered so little in comparison.

The reason behind this has been the "easy money" policies of the central banks which sent interest rates to 0%. This drove down the equity risk premium and stock prices soared faster than dividend payouts increased.

But that era now seems to be over. Today, with inflation remaining persistent, central banks are tightening, the money supply is falling, and stock prices are under pressure.

With 5% yields now obtainable with 2-year Treasuries and around 4% yields on 10-year Treasuries, there is now a disequilibrium between dividend yields and available yields in the credit markets. And let's not forget taxable equivalent yields on munis are near 7%.

The challenge for all investors will be learning to navigate when the tailwinds have become headwinds.

How to Invest for Dividends in a Low-Dividend Yield Environment

With dividend yields low overall, it might be tempting for an investor to seek out those stocks with the highest yield but that could be a costly mistake. Some of the risks include:

- Dividend cuts: Companies that pay high dividends may not be able to sustain those payments if their earnings or cash flows decline. This can lead to dividend cuts or suspensions, which can result in a decline in the stock's price and a reduction in income for investors.

- Poor financial health: High dividend yields may sometimes be a sign of a company that is struggling financially. A company that is paying out a high percentage of its earnings in dividends may not have enough cash flow to reinvest in the business or pay off debt, which could hurt its long-term prospects.

- Limited growth prospects: Companies that pay high dividends may not have as much room for growth as companies that reinvest their earnings back into the business. This could limit the potential for capital appreciation, which is an important source of long-term returns.

Fortunately, I have discovered some better ways that will help to minimize these concerns.

Starting Universe,

Quality is likely to be one of the most important factors in this environment.

One of the best ways to discover quality dividend-paying companies is, to start with a quality universe. Here are a few popular lists where you will find high-quality dividend-paying stocks.

"Dividend Achievers" are companies that have consistently increased their dividend payments to shareholders over a period of at least 10 years. This term is often used by investors and financial professionals to refer to companies that have a strong track record of paying and growing dividends over time.

Dividend achievers are typically well-established, financially stable companies with a history of generating strong cash flows and profits. They may come from a variety of sectors and industries, including consumer staples, utilities, and healthcare, among others.

The ability to consistently increase dividend payments is often seen as a sign of financial health and stability, as well as a commitment to creating value for shareholders. Companies that are able to achieve this level of consistency over a long period of time may be particularly attractive to income-oriented investors who are looking for reliable sources of income.

The Dividend Aristocrats are a more narrow subset of the Dividend Achievers and include S&P 500 companies that have increased their dividends for at least 25 consecutive years.

In the United States, the longest-running dividend payer is believed to be the utility company Consolidated Edison (NYSE: ED), which has paid dividends continuously since 1885.

Other US companies with a long history of paying dividends include the tobacco company Altria (formerly Philip Morris), which has paid dividends since 1924, and the consumer goods company Procter & Gamble, which has paid dividends since 1890. Other notable long-term dividend payers in the US include Coca-Cola, Johnson & Johnson, and ExxonMobil.

These latter companies are part of an elite group of stocks known as Dividend Kings -stocks that have paid their dividends for at least 50 consecutive years.

Incidentally, in case you were wondering, the longest-running dividend payer in the world is believed to be the Swedish engineering company Stora Enso, which has paid dividends since 1878.

Ways to Invest.

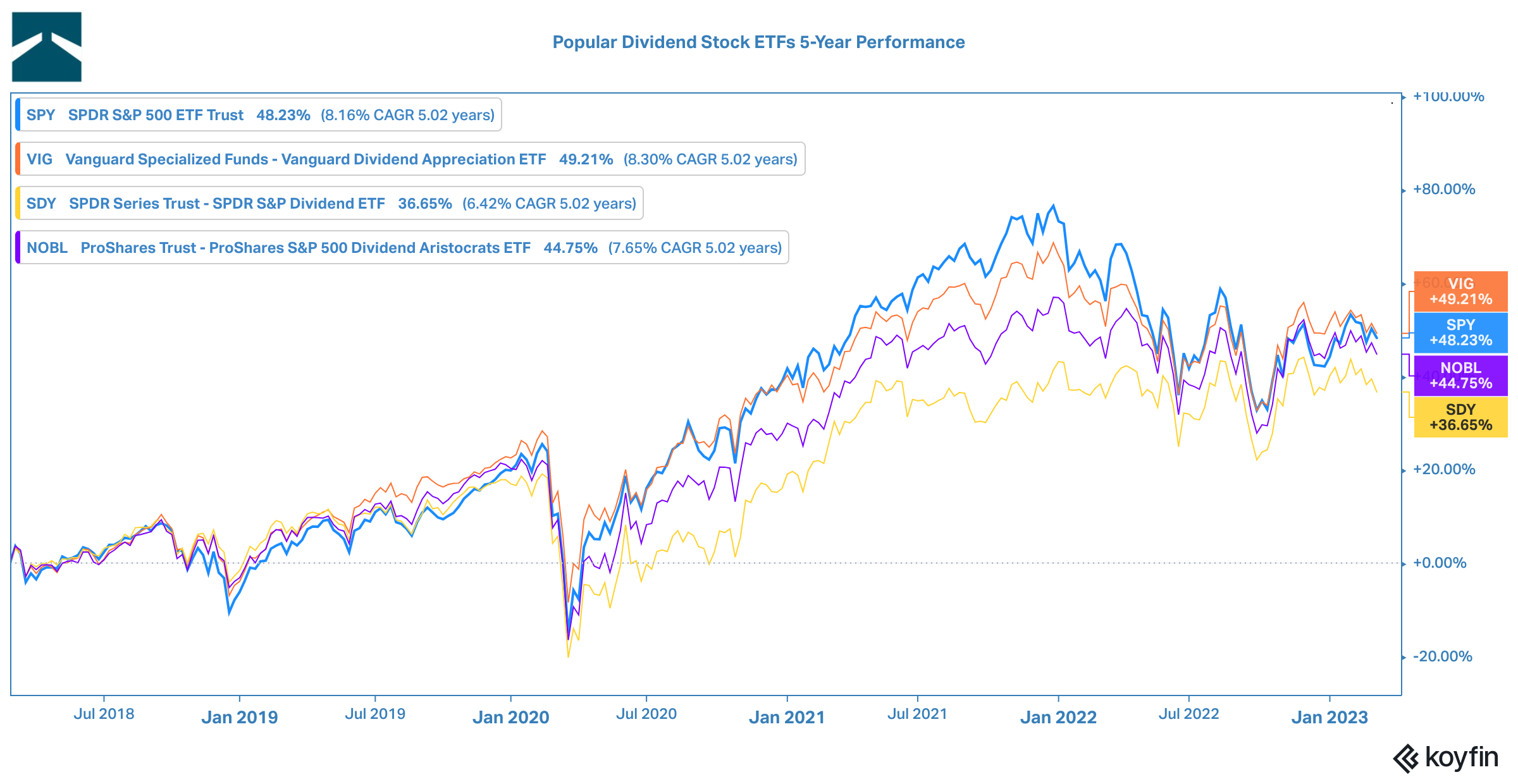

First, there are some popular Exchange-Traded Funds (ETFs) that track Dividend Achievers. Here are three:

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL): This ETF tracks the S&P 500 Dividend Aristocrats Index, which includes companies in the S&P 500 that have increased their dividends for at least 25 consecutive years.

- Vanguard Dividend Appreciation ETF (VIG): This ETF invests in US stocks with a history of increasing dividends for at least 10 consecutive years. It tracks the NASDAQ US Dividend Achievers Select Index.

- SPDR S&P Dividend ETF (SDY): This ETF tracks the S&P High Yield Dividend Aristocrats Index, which includes companies in the S&P Composite 1500 Index that have increased their dividends for at least 20 consecutive years.

Caveat Emptor!

While buying an ETF provides a fast and easy way to buy a basket of Dividend Achievers, it is my least favorite approach. Why?

Because these typically just follow the market as this chart demonstrates.

They tend to rise and fall with the market and offer no special “excess” return.

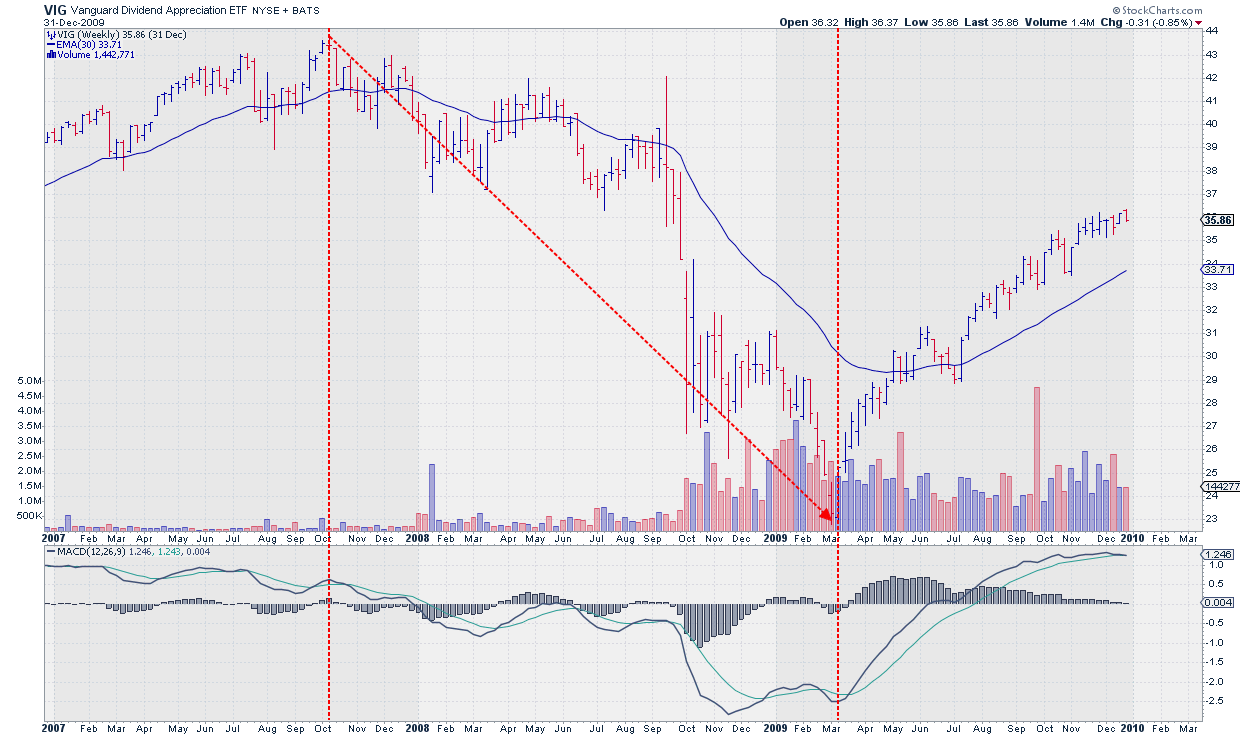

Even worse, there is no risk management as the fund managers will stay fully invested during a market correction.

During the Great Financial Crisis in 2008-2009, Vanguard Dividend Appreciation Fund lost 48% of its value! No amount of dividend income will ever compensate for that kind of loss.

A New Approach to Dividend Investing

In the face of rising interest rates, historically low dividend yields, and a stock market that has been teetering from the threat of recession, I believe that investors need an approach that can marry together risk management with a fundamental approach to dividend investing.

In what I call the “Quantamental” approach - I blend quantitative, fundamental, and technical analysis in an approach that has historically provided a market"edge".

Let me illustrate the process.

Step 1. Quantitative Factor Scoring

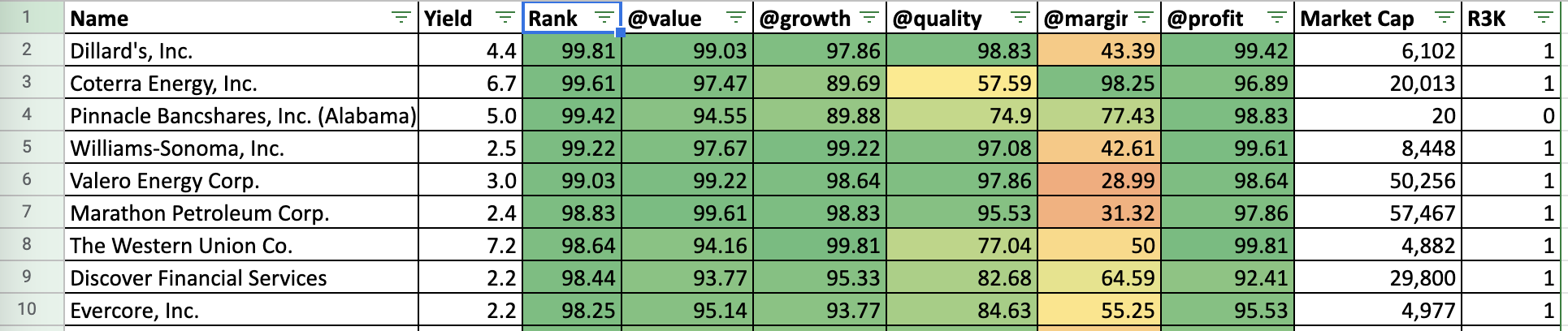

I begin with a universe of dividend-paying stocks that pay at least a 2% yield and then rank them on the basis of factors such as value, growth, quality, margins, and profitability. This gives me the ability to find companies that not only pay a dividend today but also have the ability to continue paying dividends in the future. Quality is paramount in today's environment.

This provides me with a list to further research which looks like this;

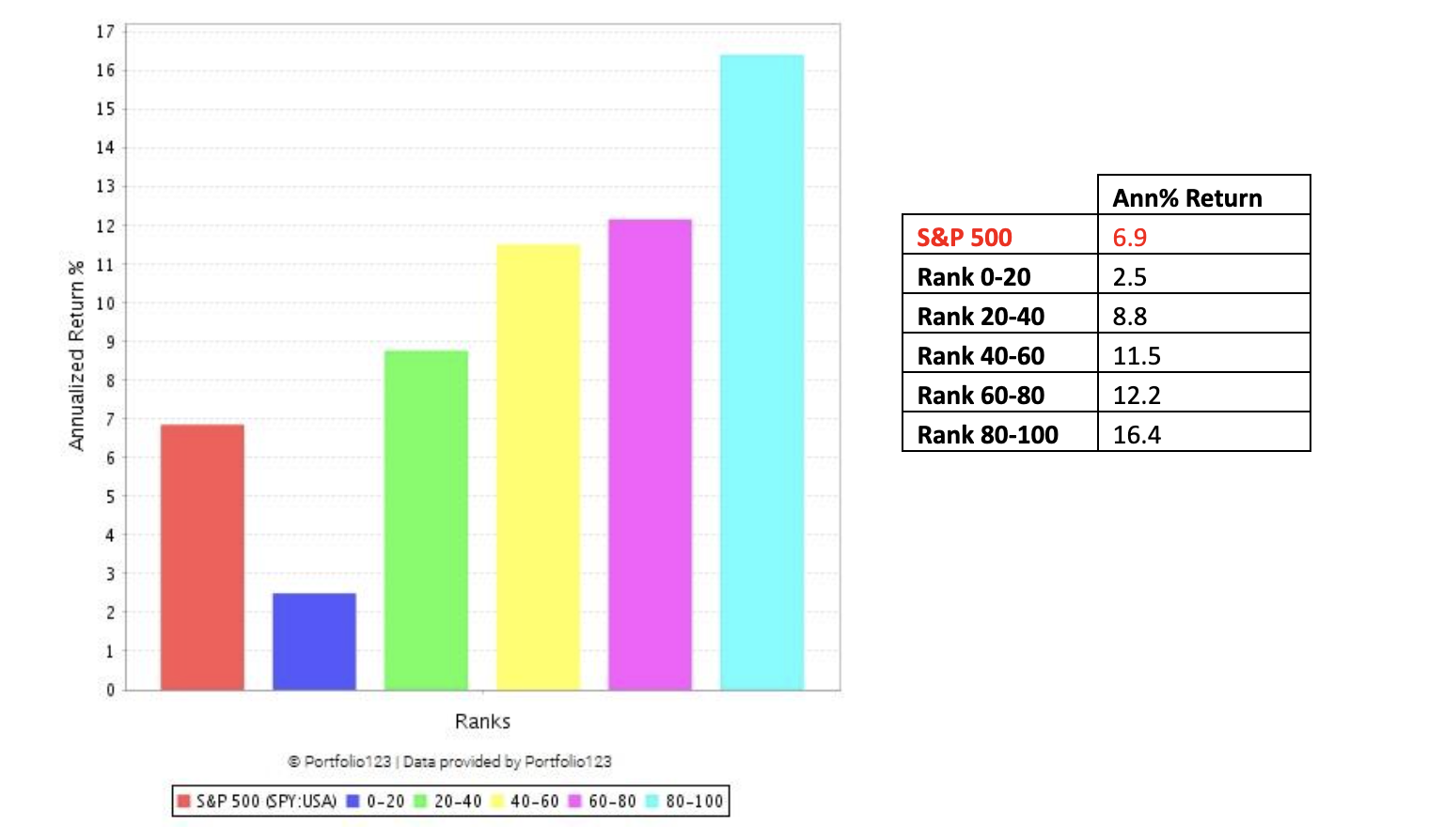

Next, I only consider stocks that are ranked 80 or higher in my composite ranking, If I did nothing else, this would place me in the top 1% of investors as the compound return of these top-ranked stocks is 16.4% since 1999 vs. 6.9% for the S&P 500.

Presently, there are around 100 stocks that meet or exceed an overall ranking of 80. This is still quite a few to consider. Let’s narrow it down further using a combination of technical factors.

Step 2. Sector and Industry Ranking

I begin by applying relative strength at multiple levels. The goal is to find strong stocks within strong sectors and strong industries.

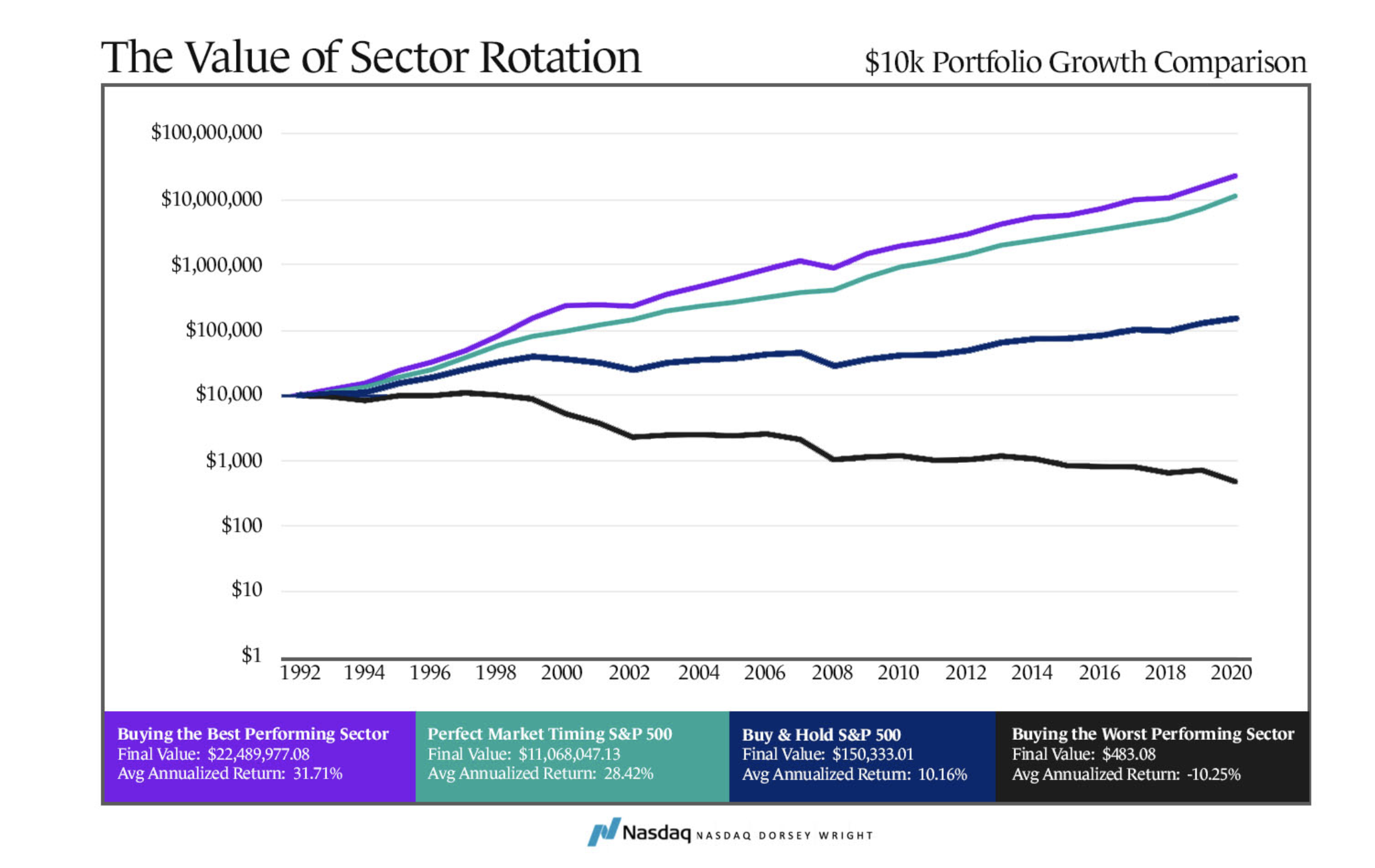

The importance of picking stocks from strong sectors cannot be overstated. This chart demonstrates the astonishing performance attribute of investing in the best-performing sectors.

To illustrate this process, here is a recent example.

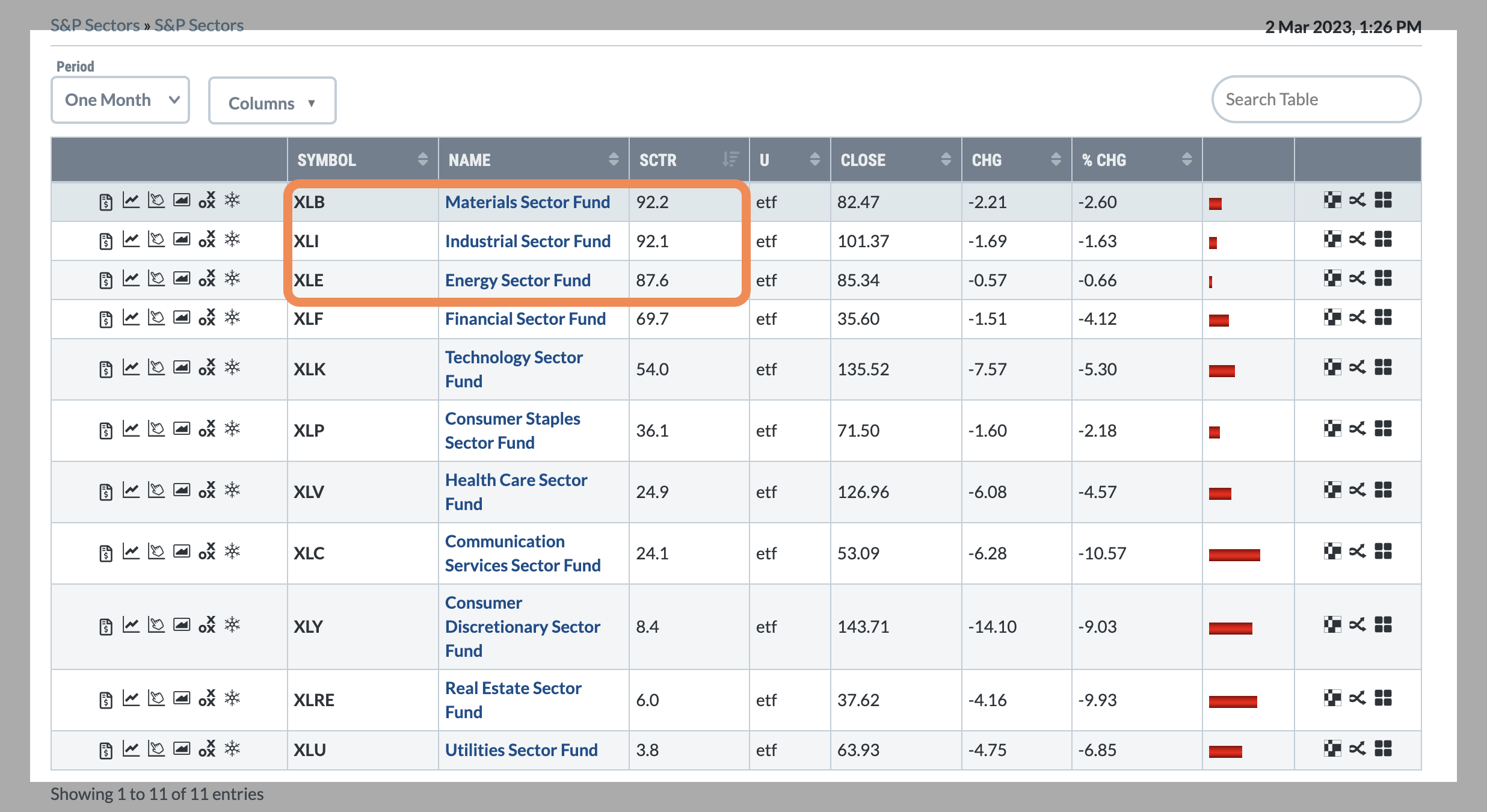

Currently, we can see that on the basis of relative strength, Materials, Industrials, and Energy are the 3 current strongest sectors.

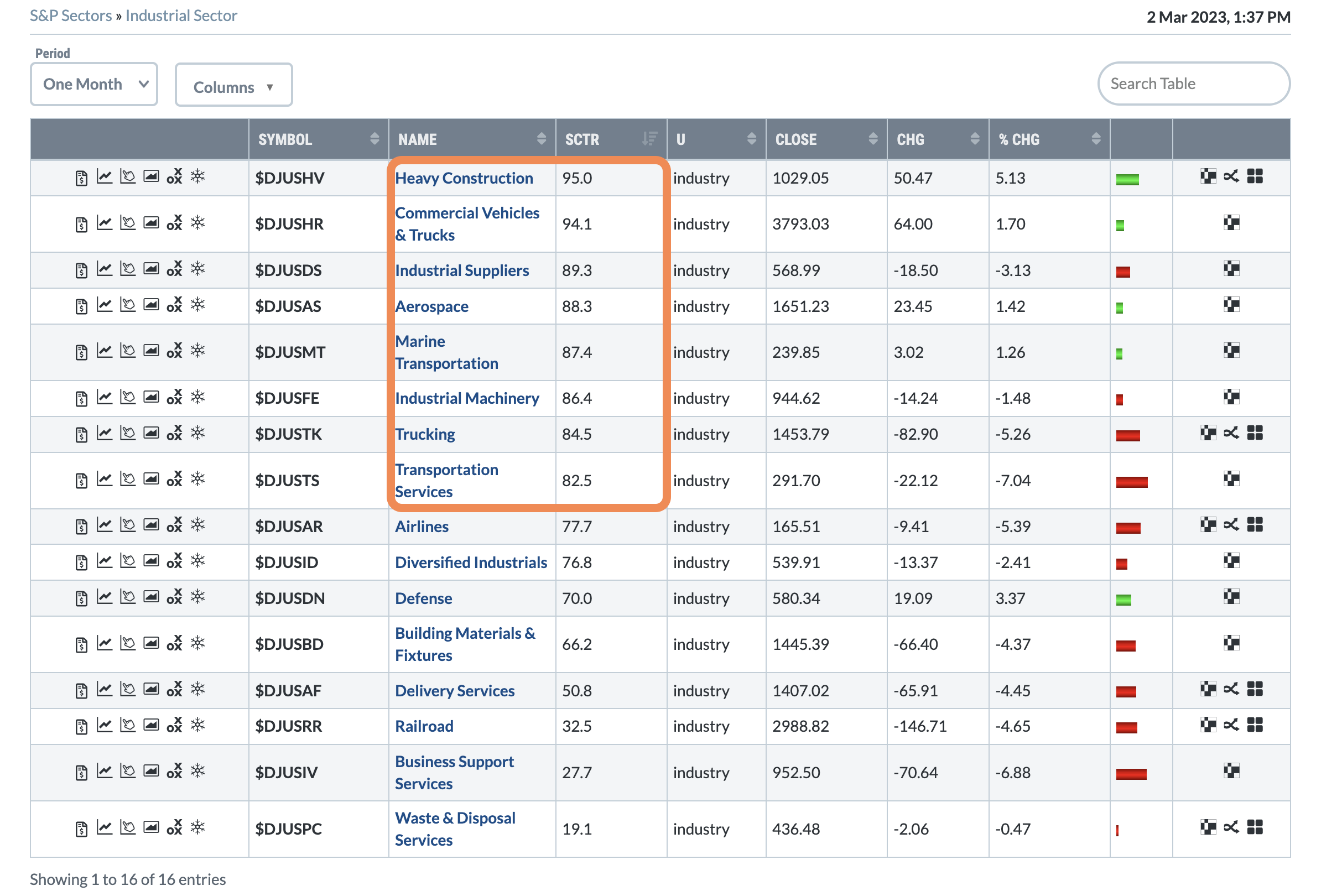

Next, if we drill deeper into each sector, we can see what industry groups are displaying the greatest strength.

Within the Industrial Sector, there are currently nine industry groups that display strong relative strength.

(For these examples, I have used StockCharts.com, a service that is available to all investors. SCTR is a numerical technical rank.)

With this information in hand, it is now easy to cross-reference the master list and look for stocks with a composite ranking of 80 within one of these top industries.

A company that recently resulted from this process is AGCO, a manufacturer, and distributor of farm equipment paying a nearly 4% dividend yield. This is a member of the commercial vehicle industry group which is a subset of the Industrial sector.

The final step is to check the stock against some additional technical and fundamental rankings.

While no system will ever be perfect, such an approach is designed to put as many factors as possible behind every selection to help increase the probability of success.

And while this approach requires more work, it assures we have found a dividend-paying stock that has both strong fundamentals and strong technicals.

Step 3. Risk Management

No approach to investing in the stock market would be complete without a method to manage risk. Understanding whether supply or demand is in control in unambiguous terms is critical to protecting one's capital.

Some of my favorite tools that investors can use for this purpose include bullish percent indexes, moving averages, and absolute momentum ranking.

The goal is to accurately define the market conditions and to know the appropriate response.

Conclusion

The challenge today for dividend investors is that overall dividend yields are low when compared to historical averages, and at a time when central banks are aggressively increasing interest rates.

Further, there are increasing signs of a recession implying that many companies’ balance sheets and profit margins will be under pressure.

Blindly buying "dividend stocks" without considering for the current macro environment and the underlying fundamental of a company will likely lead to disappointment.

For dividend investors, there has never been a more important time in recent history to focus on quality, performance, and risk management as current dividend yields will probably not be enough to cushion stock market declines.

If you would like to follow me as I build a portfolio of the very best dividend-growth stocks, please join the Dividend Growth Portfolio where I will be updating a portfolio that was started on March 1.

Stay connected with news and updates!

Join the newsletter to receive the latest news and updates on building a more intelligent portfolio. Earn More. Risk Less.

I will never sell your information for any reason.